This article is part of a series from our latest whitepaper, the China Social Media Platforms Guide. You can download the guide here: https://www.umssocial.com/china-social-media-platform-report/2024?s=blog

INTRODUCTION:

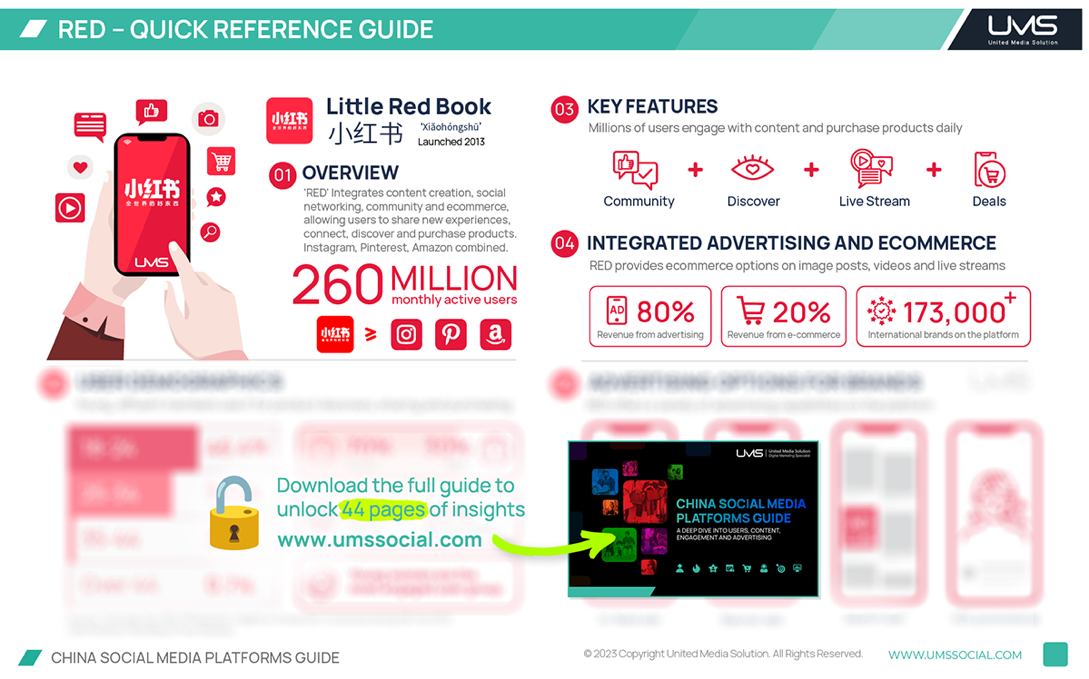

Xiaohongshu, also known as RedNote, uses the slogan ‘Mark your life’, and is aimed at becoming a lifestyle community for young people. It was launched in 2013 and has since grown to over 300 million monthly active users, with the majority being female Millennials from Tier 1 and Tier 2 cities. The platform integrates content creation, social networking, community, and ecommerce allowing users to share new experiences, connect, discover, and purchase products.

RedNote, also known simply as ‘RED’ (which means popular and lucky in China) is not just a social media platform, but also a major search engine and ecommerce platform that allows users to purchase products and share shopping experiences. It can be described as a combination of Instagram, Pinterest, and Amazon. RED is a key player in the social media landscape, with a similar level of brand power that Instagram has in the West.

KEY FEATURES:

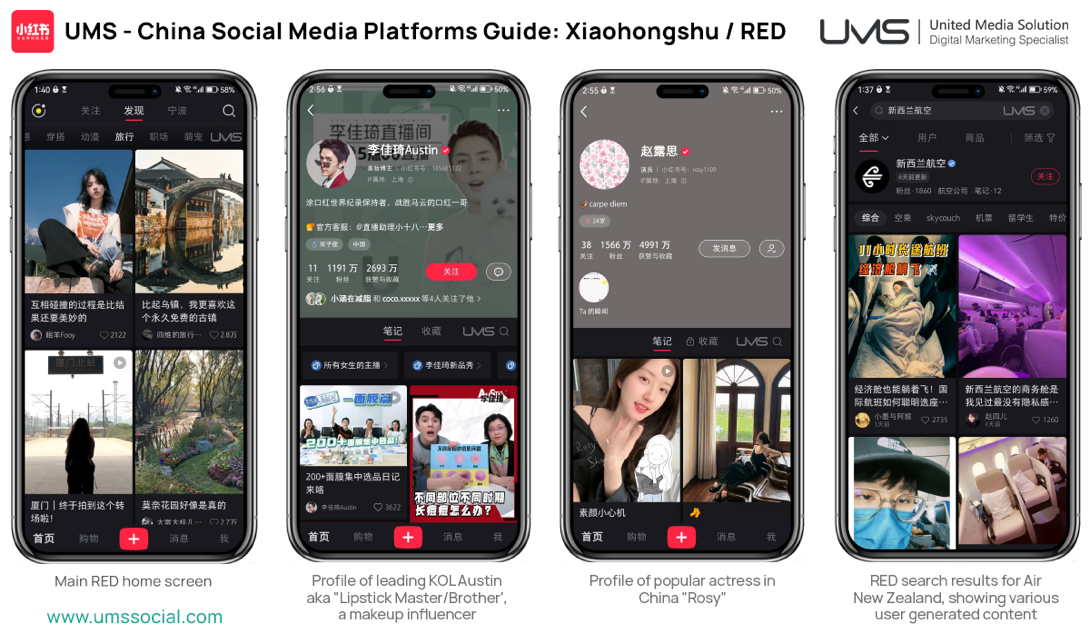

- Home feed: The home feed features three tabs to display Following, Explore and Nearby content that is personalised, based on the user’s interests, location, and behaviour on the platform.

- Search: Users can search for products, brands, influencers, and topics on RED. Sixty per cent of platform members use the search function daily.

- User profiles: Each user has a profile that includes a username, profile picture, biography, content they have created or saved and their total number of followers.

- Community groups: RED has a range of community groups focused on different topics and trends where users can connect, discover, and share content.

- Live-streaming: RED has a video live-streaming feature that allows influencers and brands to connect with their audience in real time with comments and reactions.

- In-app ecommerce: Users can buy products directly inside the platform, via posts or inside live-streams.

USERS AND BEHAVIOUR:

RED users are predominantly female, but males are quickly joining too. Overall 85% of users are under the age of 35, are lifestyle-conscious and have high purchasing power. They are also social media savvy and tend to follow the latest trends in daily life. They trust user-generated content and peer recommendations and often use RED as a guide for purchasing decisions. Users are highly engaged, spending around 70 minutes on the platform daily.

⭐ POPULAR CONTENT:

Beauty tutorials, product reviews, fashion, trending activities, and English learning are the most popular types of posts on RED. Users often create visually appealing content that provides helpful tips and recommendations. Influencers and KOLs (Key Opinion Leaders) also play a significant role in shaping the content on the platform. Many young users aspire to gain enough followers to become professional KOLs. Many use live video streaming to engage with their followers on a regular basis and host Q&A sessions and giveaways. RED has become a go-to source for users to discover the latest trends and new products.

POPULAR CATEGORIES:

User-generated content that is published in key categories on RED automatically attracts more likes and shares as the algorithm picks it up and promotes it further. Brands can leverage this to create aligned content that is linked to popular go-to categories.

ACCOUNT TYPES:

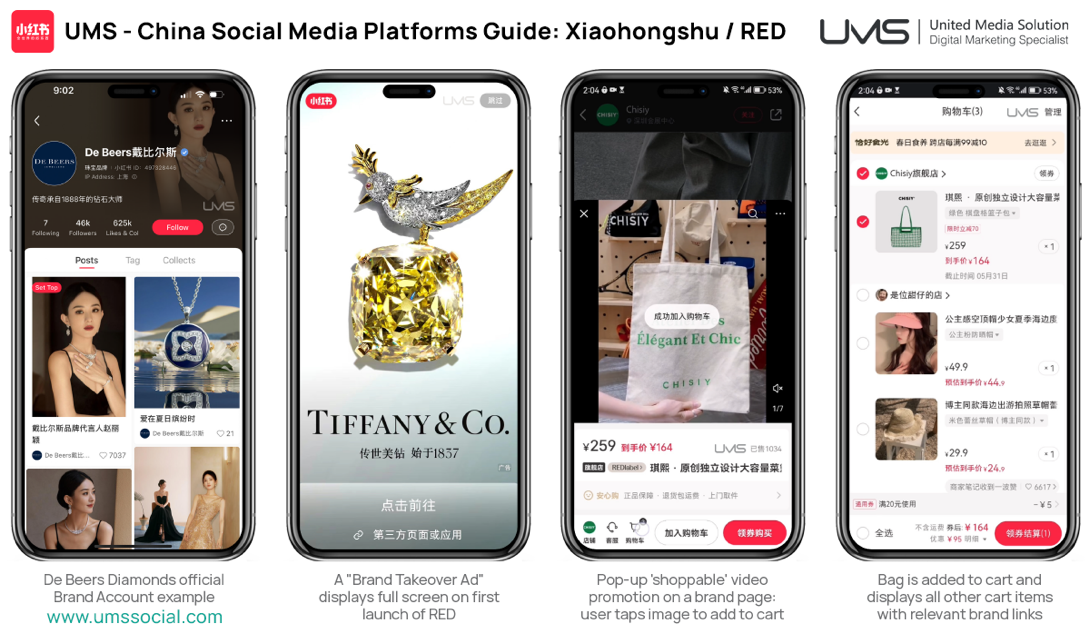

RED offers two types of accounts: Personal accounts are for individuals to share their content and engage with other users. Brand accounts are for businesses that want to promote various products and services. Brands can collaborate directly with influencers and KOLs to reach their target audience. RED has strict guidelines for brands to ensure that they provide valuable and authentic content to users. Both personal and business accounts can boost content for higher engagement.

ADVERTISING OPTIONS:

RED offers various advertising options, including brand takeover ads (appears on the first launch of the app per day), in-feed banner ads, keyword search ads and sponsored posts. Brands can use these options to increase their visibility and reach on the platform.

Sponsored posts and KOL collaborations are particularly effective in reaching the platform’s highly engaged user base. RED’s advertising options are designed to be seamless and non-intrusive, ensuring the user experience remains positive, and keeping the audience on the platform longer.

ECOMMERCE OPTIONS:

RED’s ecommerce options are integrated into the social media platform, making it easy for users to purchase products and share their shopping experiences. Brands can create their own online store on the platform and sell products directly to users.

RED also offers various ecommerce tools, including live-streaming and flash sales, to help brands increase their sales on the platform. Shopping is a key focus area for RED, and the platform is continuously improving its ecommerce capabilities to better serve its users and brands. (See Social Commerce Cycle below).

CUSTOMER SUPPORT:

RED enables users to contact brands directly with one click to follow up on purchase and delivery. Users can easily join brand groups to find out more information. Brands are expected to provide prompt and helpful responses to user inquiries and complaints to help ensure that product ratings and reviews are high quality. RED’s focus on customer service and high-quality user experience has contributed to strong engagement and loyalty from users on the platform.

THE SOCIAL COMMERCE CYCLE:

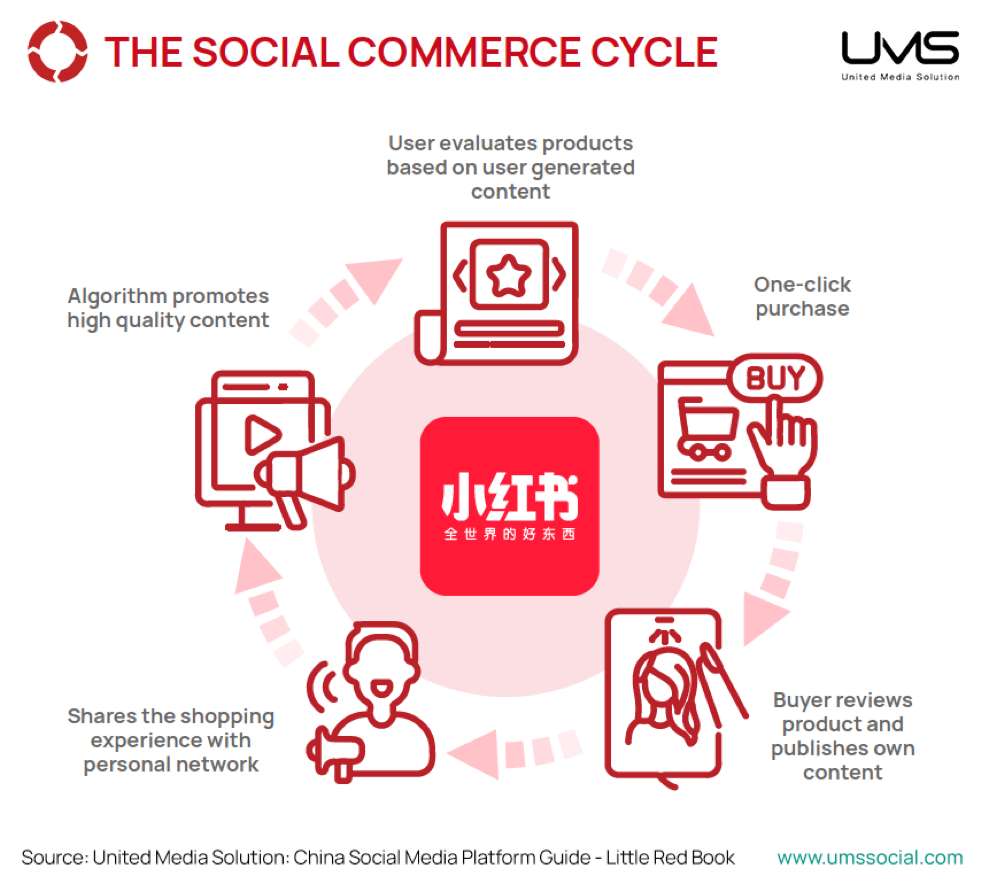

Purchasing, reviewing, sharing, commenting, searching and discovery create a reinforcing ‘Social Commerce Cycle’ that can help products and entire categories to go viral when new trends arrive.

This cycle is particularly common on RED, as it is the most popular platform for users to seek out the opinions of others, especially women looking for female influencers, then discuss the options with friends, and then shop directly with the influencer via affiliate discount links and promotions.

MARKETING TIPS:

- DEMOGRAPHICS: RED covers a range of demographics in China and is continuing to expand its audience. Understanding a target audience segment, their unique preferences and interests will help brands to help tailor advertising messages and engage the ideal consumers.

- LOCALISATION: Creating engaging and compelling content that resonates with a Chinese audience requires a deep understanding of the local culture, values, preferences, and popular trends for an audience segment. Brands need to localise their content to make it more relevant to their target audience on RED in China and not just copy-paste.

- VIDEO: Video ads are also a key form of advertising on many platforms in China, and work very well on RED. Brands can create short, engaging, and entertaining ads to reach younger audiences with short attention spans. Creating visually appealing, shareable and memorable ads will maximise their impact on RED.

- SEARCH ADS: Search advertising is still effective in China, and RED is becoming an important search engine. Search ads to can be used to target and retarget users actively searching for specific products or services, increasing the likelihood of conversion.

- INFLUENCERS: KOLs and influencers with an established following are seen as trustworthy and reliable by their followers, which can make collaborations very effective. Brands often work with KOLs to co-create sponsored content, such as product reviews or endorsements, to reach a wider audience and improve brand awareness. Finding affordable ways to work with reliable KOLs can be challenging, so UMS has a dedicated team that works directly with KOL and KOC Influencers in China.

- BRAND COLLABORATIONS: Because endorsement from popular KOLs can be expensive, working with smaller “Key Opinion Consumers (KOCs) can provide an excellent opportunity to co-create content with smaller influencers that are often publishing new content daily. They have their ‘thumb’ on the pulse of the latest music trends and post formats that gain organic traction. Combined with a solid digital campaign strategy from a partner like UMS, a brand can achieve positive results with influencer marketing.

- AUDIENCE FIRST: To succeed on RED, brands need to remain flexible, innovative and audience-centric in their social media strategy. By doing so, they can effectively tap into the potential of RED and significantly enhance their market presence and customer engagement in China.

BRAND STRATEGY:

RED is an excellent platform for brands to reach China’s younger generation and growing middle-class, particularly with women making key daily household purchasing decisions. The platform places a high value on transparency and authenticity, and users expect the same from brands. It is recommended for brands to build up a content matrix for their account that consists of organic user generated content, content from other brands and partners, combined with KOL and KOC (Key Opinion Consumer) collaborations.

An investment in authentic high-quality content and influencer collaborations, including video live-streaming, can pave the way to success, but brands should ensure that collaborations are genuine, and the products being promoted are relevant to their audience. Users value ongoing engagement and updates, in a similar way that popular magazines provide guidance as a style leader and tastemaker.

PLATFORM SUMMARY:

RED is leading the way in China to build up a lifestyle community of high quality, trusted brands, and influencers. The platform aims to help users to discover interesting new trends, and then combines that with the ecommerce capability to deliver directly to platform users.

RED already plays a significant role in online search in China, with 60% of users searching on it daily. With a large proportion of China’s young affluent and middle-class consumers using the platform each day, it is a powerful channel for brands to leverage to reach this audience.

This article is part of a series from the latest whitepaper, our China Social Media Platforms Guide. You can download the guide here: https://www.umssocial.com/china-social-media-platform-report/2024?s=blog

CHINA SOCIAL MEDIA PLATFORM ARTICLES ON THE UMS BLOG:

What is Xiaohongshu, RedNote? (China’s Instagram)

What is Douyin? (China’s Sister App of TikTok)

What is Bilibili? (China’s Answer to Youtube)

What is WeChat? (China’s “Super App”)

What is Ctrip: China’s Travel Super App Powering Global Tourism

For more Insights information contact jessica.miao@ums.co.nz, or sales@umssocial.com