INTRODUCTION: China’s Travel Super App

Ctrip, often referred to as “China’s Expedia,” has been the dominant player in China’s online travel market since its founding in 1999. As of 2024, it serves over 300 million monthly active users and holds more than 40% market share in the Chinese online travel industry.

In 2017, Ctrip acquired the global brand Trip.com and later restructured its international business under the Trip.com Group umbrella. While Ctrip continues to serve as the flagship platform for the domestic Chinese market, Trip.com functions as its global-facing brand, offering localized services and multi-language support to users worldwide.

Ctrip enables destinations and brands to connect with Chinese travelers through AI-driven recommendations, integrated booking solutions, and digital campaigns. With services covering flights, hotels, and tours in over 200 countries, the platform supports co-branded promotions, livestreaming commerce, and targeted content marketing. Beyond domestic travel, Ctrip plays a critical role in powering outbound tourism from China.

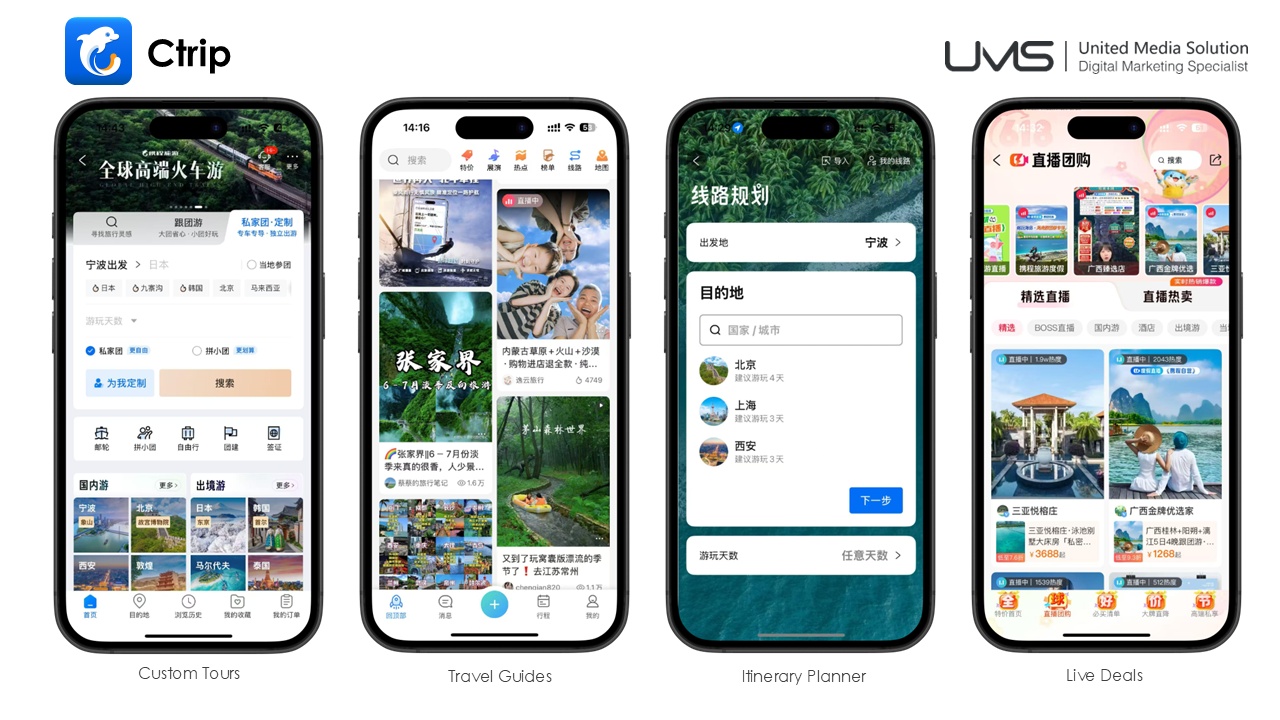

KEY FEATURES

- Comprehensive Travel Booking

Integrates flights, high-speed rail, car rentals, and over 1.8 million accommodations, plus customizable vacation packages for diverse travel needs. - Loyalty Programs

Tiered memberships (Silver/Gold/Platinum) offer exclusive discounts, free upgrades, and points redeemable for travel or merchandise. - AI Personalization

Uses deep learning to deliver personalized recommendations, with A/B testing to continuously optimize the user experience. - Travel Wallet & Currency Exchange

A digital wallet helps users manage all travel-related payments and credits. It also allows travelers to pre-book foreign currency exchange via the app and pick up the cash at Ctrip currency counters at major airports in China. - Livestreaming Commerce

Enables real-time hotel promotions via influencer live streams, driving impulse bookings through flash sales. - Global & Corporate Solutions

Trip.com supports 24 languages and 35 currencies, offering corporate tools like co-branded cards, centralized booking, and reporting dashboards.

USERS AND BEHAVIOUR

Ctrip’s user base includes young professionals and middle-aged travelers, with high-spending individuals accounting for a significant portion. Whether traveling for business or leisure, users prefer planning and booking via the mobile app. On average, users spend over 30 minutes daily on the platform, engaging with content, livestreams, and travel planning tools.

Ctrip reflects China’s mobile-first behavior and evolving travel preferences, offering a highly localized and data-driven experience.

POPULAR CONTENT

Ctrip covers the full travel journey, from destination guides and itineraries to bookings and attraction tickets. Customized private tours, local dining tips, and in-app livestream promotions attract high engagement. Big data algorithms help surface the most relevant content, creating a personalized experience that matches user interests.

POPULAR SERVICES

Hotel and flight bookings remain core, while train tickets, airport transfers, and attraction passes are highly popular in China. Staycations, themed travel (e.g., wellness, food, culture), and seasonal holiday packages see strong demand during national holidays like Chinese New Year and Golden Week. Add-on services like insurance, SIM cards, and bundled discounts (e.g., flight + hotel) enhance convenience and increase average order value.

LOYALTY PROGRAMMES

Ctrip offers both personal and corporate account types. Individual users enjoy loyalty points, VIP perks, and member-only deals. Frequent travelers benefit from premium support and exclusive offers. For businesses, corporate accounts provide employee management, invoicing, and bulk booking tools. Partners such as hotels and airlines can manage inventory, run promotions, and track performance through their own dashboards.

CUSTOMER SUPPORT

Ctrip’s reputation for reliable, multilingual 24/7 customer service is a key reason for its dominance. Users can access support via phone, live chat, or in-app messaging. VIPs and corporate clients receive priority service and dedicated account managers. For international travel, Chinese users value Ctrip’s local-language support, which sets it apart from global competitors.

BRAND STRATEGY

To succeed on Ctrip, brands must focus on visibility, trust, and responsiveness. High user ratings, fast customer service, and competitive pricing boost visibility in search rankings. Maintaining updated listings, timely responses, and strong user reviews contributes to sustained engagement. Ctrip rewards brands that treat it as a long-term relationship platform rather than just a transactional space.

PLATFORM SUMMARY

Ctrip is not just a booking tool; it’s a travel ecosystem that blends personalization, content, and commerce. With over 300 million users, AI-driven recommendations, and multilingual capabilities, it serves as a vital platform for global destinations and brands looking to engage Chinese travelers.

As China’s travel industry rebounds, Ctrip’s integrated model positions it as an essential strategic partner for long-term growth in the region.

CHINA SOCIAL MEDIA PLATFORM ARTICLES ON THE UMS BLOG:

What is Xiaohongshu, Little Red Book? (China’s Instagram)

What is Douyin? (China’s Sister App of TikTok)

What is Bilibili? (China’s Answer to Youtube)

What is WeChat? (China’s “Super App”)

What is Ctrip: China’s Travel Super App Powering Global Tourism

For more Insights information contact jessica.miao@ums.co.nz, or sales@umssocial.com